Quick Links

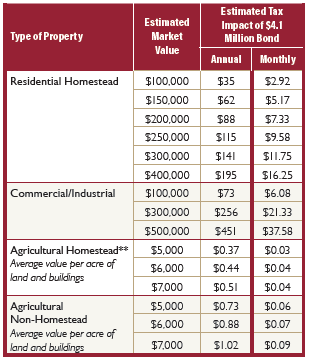

On Tuesday, November 7, 2023, Spring Grove Public Schools will ask voters to consider two bond referendum questions. QUESTION 1 - PROPOSED PROJECTS $12.195 Million Update Old and Failing Building Systems Portions of the school's heating and ventilation systems are 95 years old. The units are not working properly and parts are no longer available to repair them. The water heater and electrical panels are also in need of replacement. Replace Windows and Roof Sections The glass block and single pane windows in the school are inefficient and in need of replacement. Sections of the roof are beyond their service life and need to be replaced. Expand the Kitchen and Cafeteria The school's kitchen needs to be expanded and redesigned to more efficiently prepare and serve students' lunch. The kitchen coolers need to be relocated within the kitchen and the cafeteria expanded to provide needed seating for school and community use. Expand the Art Room The art classroom is half the recommended size. A larger room with additional storage and a separate room for the kiln is needed. Update the Wood Shop Also known as Career and Technical Education "CTE" Lab There is a need to update the lighting and ventilation systems in the existing shop where welding, metals, woods, and automotive repair classes are held. Renovate Bathrooms and Locker Rooms The school's restrooms and locker rooms require updates to replace failing fixtures and address Americans with Disabilities Act (ADA) code compliance. If the community supports Question 1, the project could be further expanded through support of the $4.1 million bond - Question 2. QUESTION 2 - PROPOSED PROJECTS $4.1 Million Build a New and Expanded Shop/Career and Technical Education (CTE) Lab A new, larger Career and Technical Education (CTE) Lab is desired to increase course offerings, provide access to the latest equipment and technology, and ensure our students have real-world, hands-on experiences in the trades. The new lab would be built in the existing courtyard and the existing shop would be re-purposed into a classroom.   WHAT WILL THE BOND COST ME? Tax Impact Chart The tables below show the tax impacts for the two bond questions on various types and values of properties. Question 1 Shall the board of Independent School District No. 297 (Spring Grove Public Schools), Minnesota be authorized to issue general obligation school building bonds in an amount not to exceed $12,195,000 for acquisition and betterment of school sites and facilities including, but not limited to, replacements, upgrades, and improvements to mechanical and electrical systems, roofing, windows, bathrooms and locker rooms and\ renovation to the kitchen and cafeteria, and career and technical education space?  Question 2 If Question 1 is approved, shall the board of Independent School District No. 297 (Spring Grove Public Schools), Minnesota be authorized to issue general obligation school building bonds in an amount not to exceed $4,100,000 for acquisition and betterment of school sites and facilities including, but not limited to, constructing and equipping a career and technical education addition?  CLICK HERE TO VIEW THE TAX IMPACT CALCULATOR *Estimated tax impact includes principal and interest payments on the new bonds. The amounts in the table are based on school district taxes for bonded debt levies only, and do not include tax levies for other purposes. Tax increases shown above are gross increases, not including the impact of the homeowner’s Homestead Credit Refund (“Circuit Breaker”) program. Owners of homestead property may qualify for a refund, based on their income and total property taxes. This will change the net effect of the proposed bond issue for property owners. **For all agricultural property, estimated tax impacts include a 70% reduction due to the School Building Bond Agricultural Credit. Under current law, the School Building Agricultural Credit will remain at this level. Average value per acre is the total estimated market value of all land and buildings divided by total acres. If the property includes a home, then the tax impact on the house, garage, and one acre of land will be calculated in addition to the taxes per acre, on the same basis as a residential homestead or non-homestead property. If the same property owner owns more than approximately $2.15 million of agricultural homestead land and buildings, a portion of the property will be taxed at the higher non-homestead rate. COMMUNITY INFORMATIONAL MEETINGS Monday, October 2, 2023 7:00–8:00 p.m. Spring Grove Public Schools Library Media Center Tuesday, October 3, 2023 12:00–1:00 p.m. Spring Grove Public Schools Library Media Center Tuesday, October 10, 2023 5:00–6:00 p.m. Spring Grove Public Schools Library Media Center Tuesday, October 17, 2023 5:00–6:00 p.m. Spring Grove Cinema WHERE TO VOTE ON TUESDAY, NOVEMBER 7 Fest Building 110 North Division Avenue Spring Grove, MN 55974 Polls will be open from 7:00 a.m.–8:00 p.m. EARLY VOTING Starting Friday, September 22 Absentee ballots will be available starting Friday, September 22 at the District office, 113 2nd Avenue Northwest, during regularly scheduled hours from 8:00 a.m.–4:00 p.m. and up until 5:00 p.m. on Monday, November 6, 2023. QUICK LINKS April 2023 Community Survey Results Educational Adequacy Report Facilities Assessment Report Referendum Brochure |

rove Public Schools

rove Public Schools